For our shippers

Fuel surcharge mechanism implies that the costs of diesel will be determined through the calculation of the monthly average of the officially published fuel price by the European Commission (Oil Bulletin).

Surcharge calculation

The Reference Price calculation uses the 2021 Weighted Average EU Diesel Prices (excluding VAT).

Fuel Surcharge % = [(A-R)/R] x F

Reference Fuel Price (R): € 1.12 / 1 L

Fuel Share (F): 25%

Avg. Monthly Fuel Price (A) = 2 month lag, excl. VAT

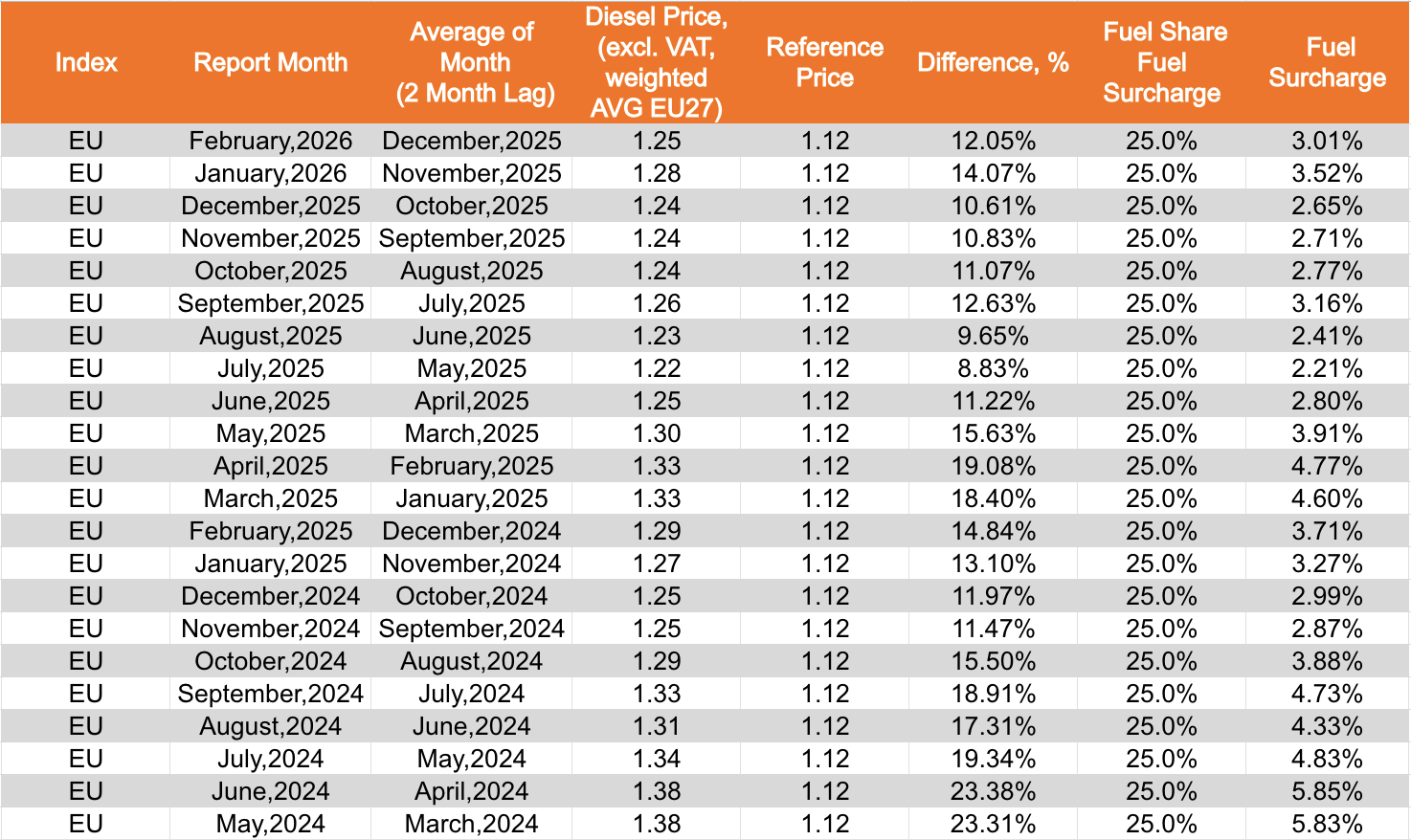

Latest rates table

Shipper-facing, see notes below table

(*) Please note: Although every effort has been made to provide complete and accurate information, sennder makes no warranties, express or implied, or representations as to the accuracy of content on this website. sennder assumes no liability or responsibility for any error or omissions in the information contained in the website or the operation of the website.

Tender price adjustments

The rules of the adjustment on the tendered price will apply based on the following points:

Given potential VAT adjustments across EU countries, all fuel prices are excluding VAT.

The fuel price will be reviewed on a monthly basis. Therefore, the freight price may be adjusted every month.

Fuel prices used to determine Fuel surcharge% are based on a 2 month moving lag (e.g. in March, average Fuel Price of January will be used). All weeks ending within the reported month are taken into consideration.

For every at least 4% difference in fuel price to the reference price, the freight price will be adjusted by 1%. If the fuel price changes less than 4%, then no changes in the freight price will be applied.

Application may result in an increase or decrease of fuel and freight price.

Workable example:

In March, Fuel Surcharge% calculation, the average diesel price of January is used (2 month lag). January's average EU diesel (€ 1.26 / 1 L) price was +13% higher versus the reference price (€ 1.12 / 1 L). After applying a 25% fuel share, the fuel surcharge% for the month of March is set at 3.1%

Frequently Asked Questions (FAQ)

Why does sennder use the EU index?

The EU bulletin index is the only free, publicly available index that covers all EU countries on a weekly basis - sennder wants to have a consistent, open, transparent source of data.

What happens when we agree on a price of transport at a certain date but the transport is only operated several months later?

The price of transport will be reviewed accordingly with the variation of the fuel price between the time of contracting and when the transport is actually carried out. As an example, if a price is agreed upon in January but only operated in March, the FSC mechanism will apply to calculate the change in price from January to March.

Why do you use 2 month lag?

The EU bulletin is published each week a few days after its week ending date. Considering this reporting delay, it is not possible to use the most recent month, as the late update could lead to operational challenges.

Why do you exclude VAT?

Whilst VAT rate changes are made relatively infrequently, changes such as those seen in Poland during Q1 2022 (from 23% to 8%) have a huge impact on the “incl. VAT” rates paid by consumers, but carriers, not ultimately paying fuel VAT or able to offset, are not directly impacted. Changes to fuel excise duty do directly impact carriers.

How do you exclude VAT?

Using the EU bulletin, “2005 onwards” file, we deduct the relevant VAT (sheet “VAT”; Note: weekly VAT figures not listed, but can be calculated on a VAT rate valid from:to calculation) from each country (sheet “Prices with taxes, per CTR”; Note: weekly prices inc VAT and fuel duty per country, looking at ‘Gas oil automobile Automotive gas oil Dieselkraftstoff’ as the Diesel Price in Euros per 1000L) and calculate the weighted average using the 2020 diesel consumption figures by country.

This produces an identical result to taking the calculated ex VAT rates and weighting them according to this ratio. This is the standardized EU weighting approach used to calculate the “EU incl VAT” rates with no assumptions from sennder.

Worked example for a specific country:

Austria (AT) diesel price for week ending 07/03/22 was €1719

VAT rate on Diesel in Austria has been 20% since 01/01/95 (“date of entry into force”)

Ex VAT rate = Inc VAT rate / (1+VAT rate) → €1719/(1+20%)=€1432.50