Highlighting market challenges:

Road freight transportation costs in Europe hit an all time high in 2022, increasing by 13% and now stabilizing again.

Spot market halved in January 2023 versus 2022, finding new equilibrium closer to 2021 levels.

Demand for green road freight increased fivefold in 2022 and is expected to continue to grow through 2023.

Berlin, 9 March 2023 — sennder, Europe’s leading digital freight forwarder, has released the first issue of its road freight industry market report, looking at the multiple factors triggering road freight market volatility. The report offers an analysis of changing market trends, including a price increase in certain European road freight corridors, the impact of the war in Ukraine on the market, the multifactorial causes of rising fuel prices, and rising demand for green logistics, as well as considerations and outlook for the road freight market in 2023.

Thomas Christenson, Chief Operating Officer, of sennder said: “Over the last three years, we navigated the most substantial and unprecedented set of macro-economic shocks to logistics in decades. Driver shortage, record-high fuel prices, supply chain disruptions, war, and inflation spawned market volatility. We anticipate that these macro-economic structural issues will continue into 2023, and have analyzed the root of each of these issues in this report.”

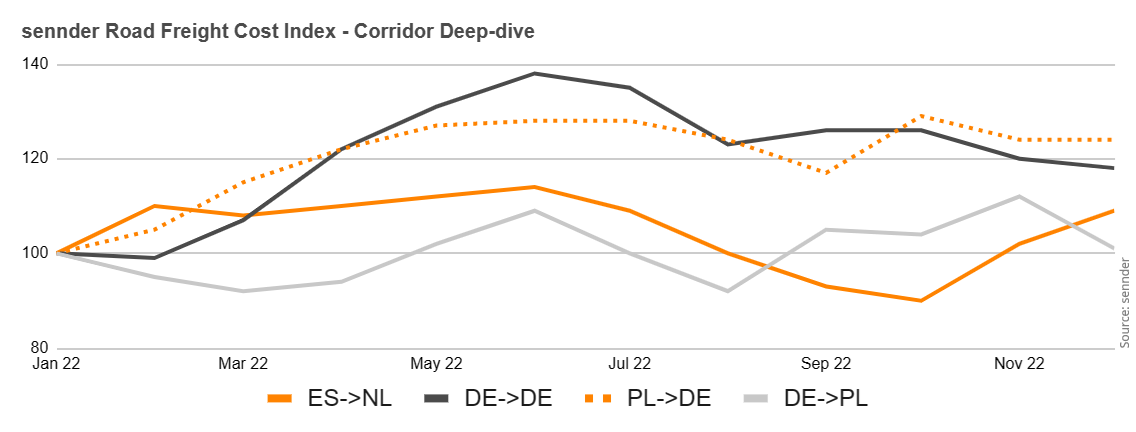

1) European road freight transport costs at record level — increases of up to 24% on certain routes

Due to record high fuel prices and tightening driver shortage, road freight transport costs increased in 2022 by 13% across Europe. Specific country corridors were much more varied. Costs for Polish outbound routes towards Germany increased by 24% from January to December 2022, despite relatively weak exports throughout the year. Domestic corridors in Germany, which are typically one of the most capacity constrained corridors, saw an increase in rate by 18% in 2022. The Spanish outbound route towards the Netherlands grew by 9%, less than market average, as Spain’s key agricultural exports suffered from extreme temperatures and drought over the summer. In 2023 the general cost trend flips, as economic activity has continued to weaken alongside seasonal lows: across Europe, transportation costs have declined in January and February 2023 below January 2022 levels by 4%.

The sennder cost per kilometer index indicates the unweighted average development of sennder’s carrier cost base (including fuel and other surcharges) in the sennder network of more than 40,000 trucks across Europe.

The sennder cost per kilometer index indicates the unweighted average development of sennder’s carrier cost base (including fuel and other surcharges) in the sennder network of more than 40,000 trucks across Europe.

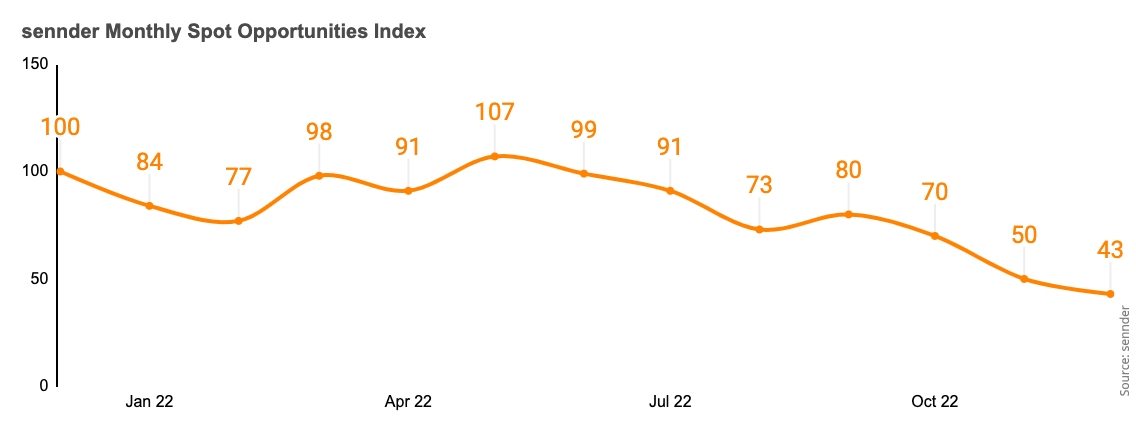

2) Spiking spot rates leading to higher contract rejection rates for many carriers

The sennder spot opportunities index reveals that the spot market had a particularly active first half of the year in 2022. Historically tight market conditions and spiking spot rates led carriers across the market to reject contracted loads in favor of more profitable spot loads. This self-reinforcing cycle meant that more shippers were forced to turn to the spot market, stoking spot opportunities by 7% in May 2022 compared to January 2022. As the market loosened in the second half of the year, spot opportunities declined by more than 50% and prices reached parity with contract rates in November. While this trend continues in the beginning of 2023, it is hard to predict the outlook given the intrinsic link to the wider economy.

The sennder spot opportunity index indicates the relative volume of spot freight opportunities indexed to January 2022. This is on a like-for-like basis with a constant cohort of shippers.

The sennder spot opportunity index indicates the relative volume of spot freight opportunities indexed to January 2022. This is on a like-for-like basis with a constant cohort of shippers.

Thomas Christenson, Chief Operating Officer, of sennder said: “Carriers operate on slim margins, so there is a limit to how much lower spot rates can go. Assuming Europe starts to recover in the second half, relatively large rate increases can be expected as structural weaknesses such as the driver shortage kicks back in and oil prices return to historic trajectories.”

3) Increasing demand for advanced fuels and green road freight

The increased importance shippers place on transport sustainability not least due to tightening policy requirements make the introduction of green transportation solutions more than a trend. sennder’s own data indicates increasing demand for green transportation solutions. In 2022, the volume of green loads (incl. renewable diesel, electric as well as multimodal transports) shipped through sennder’s platform has increased fivefold. This trend is expected to continue into 2023.

Graham Major-Ex, Director of Green Business & eMobility, of sennder said: “In the immediate term advanced fuels are an excellent way to reduce carbon emissions without additional capital investment in vehicles or infrastructure. These advanced fuels, like HVO, allow carriers to differentiate themselves and win additional business from shippers who are demanding low carbon solutions. We believe this is a permanent trend. Thinking beyond today, we believe the implementation of electric trucks at scale is right around the corner and the future of heavy road freight logistics.”

4) Outlook for 2023

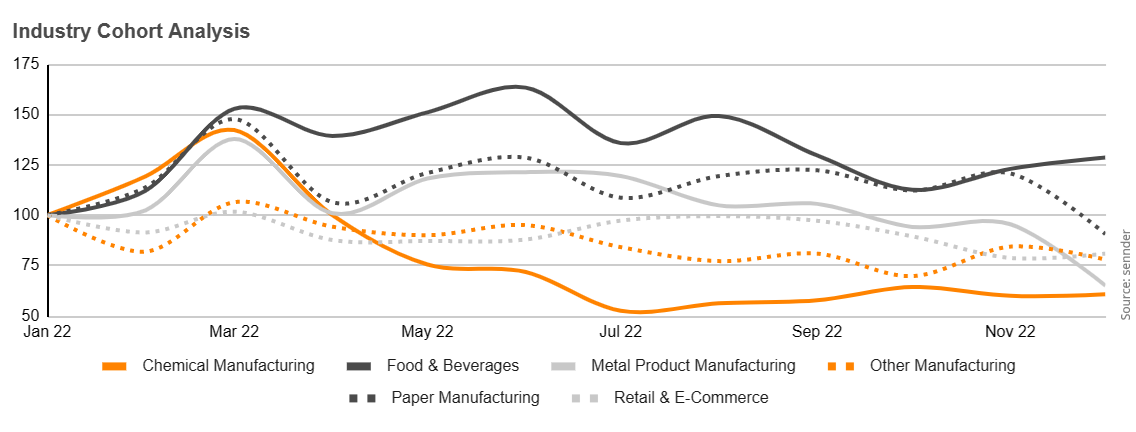

As sennder’s industry cohort analysis reveals, shippers producing essential products such as Food & Beverage are expected to hold up better in the current volatile market environment. Historically, durable goods (especially big-ticket items like cars) tend to experience the biggest decline during recessions as consumers feel uncertain about their future spending patterns. The flip side is these tend to bounce back fastest in the recovery. The speed of China’s emergence from its wave of Covid will be a key determinant of export recovery and supply chain issues.

sennder’s industry cohort analysis is based on the volume of freight loads provided by sennder to different industries on a like-for-like basis i.e. removing the impact of changes in won and lost business.

sennder’s industry cohort analysis is based on the volume of freight loads provided by sennder to different industries on a like-for-like basis i.e. removing the impact of changes in won and lost business.

Access the full report in our Resources section

Press contact

About sennder

sennder was founded in 2015 by David Nothacker, Julius Köhler and Nicolaus Schefenacker, and is now the leading European digital freight forwarder, offering shippers access to our connected fleet of thousands of trucks. In a traditional industry sennder is moving fast and focuses on the digitalization and automation of all road logistics processes. sennder deploys over 40,000 trucks across Europe, with access to more than 120,000 vehicles, and has a team of over 1,000 people. By leveraging its proprietary technology, sennder builds an ecosystem that leads the industry into the 21st century with a new degree of transparency, efficiency and flexibility. sennder is backed by some of Europe’s leading investors including Baillie Gifford, Accel, Lakestar, HV Capital, Project A, Next47, Scania Growth Capital, Earlybird and Perpetual. Additionally, sennder joined forces with industry champions Scania and Siemens to assure innovation and state of the art offerings.

)

)

)